After more than a decade of enjoying mobile phone plans that were subsidized by various high-tech companies, Mrs. Money Mustache and I were finally brought back down to Earth this month as she shed the last remnants of her cushy part-time job.

This meant that suddenly we were paying for our own double iPhone habit out of our own pockets, which at $110 per month combined, was a pretty Antimustachian thing to leave on the books. Sure, we can afford it and they are still used mostly for “work”. But it is an inefficient way to handle our communications, since neither of us is a heavy phone user. Our existing carrier (AT&T) did not offer any reasonably priced plans for light users (the mandatory data package alone runs $20/month for 300MB, whether you use it all or not). So we went hunting.

The goal was to combine the best aspects of mobile and smartphone ownership (nationwide calling without long distance fees, having your phone, email, internet access, recipe book, camera, video recorder, voice recorder, calendar, notepad, music player, virtual scratch turntable, etc. all in a single device that is always in your pocket).. with the minimal cost associated with a ‘dumbphone’ on a prepaid plan.

As I’ve learned over the past year from some of the MMM readers, nowadays you can do just that. You can take an existing smartphone (iPhone of any version, Androids such as the Samsung Galaxy, and many others), and by simply swapping out the SIM card, bring it to another mobile carrier. You even get to keep your old phone number when you switch companies.

Many of these new options are called Mobile Network Virtual Operators (MNVOs), and they are in fact just re-selling access to the bigger carriers’ networks. So you get the same reception, coverage, and reliability as you had before.

I’ll start with the juicy end result: Mrs. MM and I now have our iPhones running on plans that cost us only ten bucks per month. That includes any combination of the following:

- Up to 250 minutes of voice calling, which uses up your $10.00 at a rate of 4 cents per minute.

- Up to 500 text messages, which use up your balance at 2 cents per message (in either direction).

- Cellular Data (any that you use while not on a wi-fi network) is billed at 33 cents per megabyte.

If you use up your 10 bucks, you log into your Airvoice account and add another $10. Note that there are currently some annoying glitches in the way their system works, described in footnote 1 at the bottom of this post.

The plan we’re using is called the Airvoice Wireless $10 Plan. It looks great on paper, but the company is just a bit new and flaky at this point, so be warned that it might not be quite as smooth an experience as your current Cadillac $120/month plan. However, being both Mr. Money Mustache and a retired software engineer from the telecom/datacom industry, I figured I’m up for a little Telephone Science Experiment. Especially considering the thousands it will save me (and the millions it could save the MMM readership as a whole)! By chopping a combined $100 per month from our monthly costs, we’ll end up about $17,300 further ahead every ten years after compounding, as noted in the old classic about Short-Termitis, the Bankruptcy Disease.

So let’s get into the details:

Looking at our phone use history for the past year, we found our habits would fit nicely into the new plan. My chitchatting has ranged from 58-234 minutes of voice and from 50-100 text messages per month. On top of this, most of the voice is done at home, which could just as easily be done on the computer using any of the free voice-over-internet programs including Google Talk or Skype (Google talk allows you to call regular phones for free, even between Canada and the US). And text messages from one iPhone to another don’t cost anything these days (they go through the “iMessage” feature). Plus even text messages to other non-iPhone people can be had for free, as mentioned in my Google Voice article.

Switching from AT&T to Airvoice (or a similar MNVO) took some research and quite a few steps. But to make it easy for you, here’s the summary, based on a report fresh from the keyboard of Mrs. Money Mustache, who did most of the legwork:

Steps to Switch your iPhone from AT&T to a Prepaid Plan:(in this example, we refer to Airvoice, but other MNVO carriers would be similar)

- Check to make sure that your contract is up. If you just signed up for an iPhone5, you might be hearing the litle wah-wah-wah-waaaah trumpet song right now, as you are probably locked into a 2 year contract. Come back and read this later. You can use this link to check your AT&T contract start and end dates.

- Next we’ll need to “unlock” your phone so it can run with other carriers. You only become eligible for an unlock when your contract ends. You can check unlock eligibility here.

- Request a device unlock for your iPhone through AT&T’s online formhere.

You will need your IMEI number, which you can get from your “settings->general->about” menu, or by dialing *#06# from your phone. You will receive a “IPhone Unlock Request Received” e-mail notification from AT&T. - If you are sure you’re eligible for an unlock, and you are happy with the Airvoice coverage area (see this map) go ahead and order your SIM card ($4 per card) from Airvoice Wireless here .

- If you do not have a Passcode/PIN set up for your AT&T account, go ahead and set one up now with this link. You’ll need to give this PIN to Airvoice when it’s time to port your number.

- Wait for your unlock request to get processed (it took 3-4 days for each of our requests). Once your unlock has been processed, you will receive an e-mail from AT&T called “How to Complete Your Authorized iPhone Unlock”.

- The email will tell you to plug your phone into iTunes and do a backup and restore. Once you finish, iTunes should show a “Congratulations, Your iPhone is Unlocked” message.

This worked perfectly for Mrs MM, while MMM had hacked and jailbroken his own phone earlier, so it became a can of worms. He never got the Congratulations message. But eventually we prevailed after further hacking. You can check your phone’s unlock status by typing in your IMEI at this website: http://iphoneox.com/ - Hopefully you’ve received your SIM card from Airvoice Wireless by now. Ours both came in the mail very quickly. Note: if you have an iPhone 4 or newer, you’ll need to cut down the plastic frame around the Airvoice SIM card with scissors to fit in the newer, smaller slot (as shown in headline picture for this article. See YouTube for examples. No need to do this with the iPhone 3.

- You’re all ready to purchase a calling plan and port your number! Take a look at all the Airvoice plans here. As noted earlier, we chose the $10 Talk and Text Plan, but there are also plans for heavier users, and pay-as-you-go-plans for extremely light users (which cost more per minute).

- Download any statements or other stuff you need from your old AT&T account. After step 11, your account will automatically be nuked!

- Fill out the “Port Your Number” page on the Airvoice web site: . You can also call Airvoice at 1-888-944-2355. You’ll need to provide

- your account number with AT&T

-your PIN/Passcode from step 5

- the number from the Airvoice SIM card you just got in the mail

- your AirVoice Refill PIN Number (if you don’t have one, just put xxx in this field

- the type of plan your purchased - Put your new Airvoice SIM card in the phone. You can use the end of a paperclip in the small hole in the side of the iPhone to pop out the SIM card tray.

- See if you have service! One of our phones started working immediately, and the second took and hour and required a phone reboot.

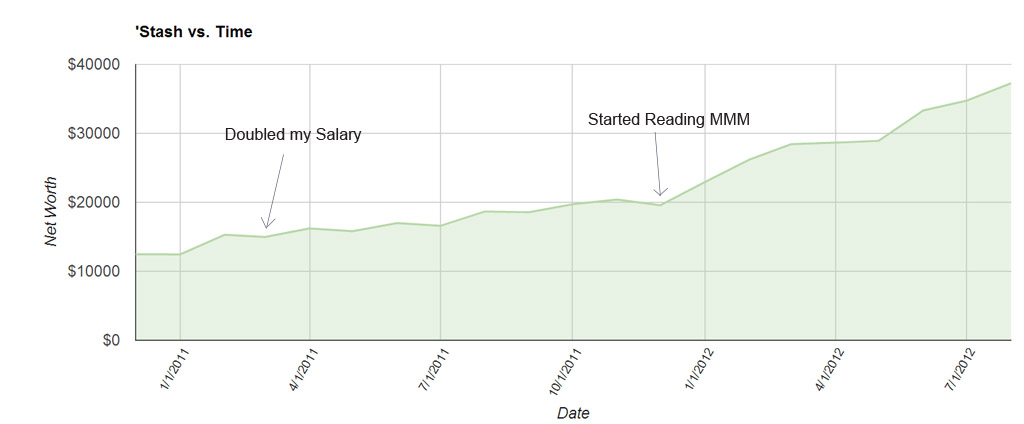

It was a long haul, but you’re finally done. In my case, I can look forward to a $1200/year savings, which translates into the cashflow generated by$30,000 of ‘stash at a 4% withdrawal rate.

Whenever you need to buy more airtime, you just use this link. After purchasing, you’ll get a confirmation e-mail with an order number.

A few notes and observations on Airvoice:

Every time you make a call or send a text, you’ll get a very useful pop-up alert like the one in this picture to let you know the funds remaining on your plan.

Every time you make a call or send a text, you’ll get a very useful pop-up alert like the one in this picture to let you know the funds remaining on your plan.

Since data is more expensive with this plan, we now disable cellular data for casual use (settings->general->cellular->cellular data-> off). Text messages and wi-fi still work perfectly, and my own town is blooming with free wi-fi spots (all public parks, schools, and most businesses around here provide free access, not to mention the blanket of coverage in my immediate neighborhood from my giant rooftop wifi antenna). So the data plan is mostly for trips and adventures.

Apple’s proprietary iMessage system still works (no charge to message from one iPhone to another), which is a nice surprise.

You might want to set up Google Talk on your home computer so that you can easily make free calls from there. This will help reduce the number of minutes you use on your phone.

The account options on the Airvoice website are pretty limited. You can edit your profile, change your password, and buy airtime, but you can’t view your usage or call history. Luckily, you get that information at the end of each call as noted above. You can also use your phone’s built-in statistics as a backup tracker: Settings – General – Usage – Cellular Uses (at bottom) – Reset Statistics.

We’ve only had this service for four days so far. And so far, so good. But as problems crop up, I will note them at the bottom of this article.

And now I’d like to turn it over to the readers: Airvoice is just one of many low-cost phone options besides the expensive main providers. Thousands of readers are probably already using other alternatives, perhaps better ones than the plan I chose for this article. Share them, give us all the details and links, and we’ll build an even better guide to killing the $100-per-month phone bill.

Alternatives include:

AT&T Operators

AT&T Operators

- Airvoice, Black Wireless, Fuzion Mobile, H20 Wireless, Straigh Talk

Sprint Operators

- Platinumtel, Ting, Republic Wireless ($20/month for unlimited everything)

Verizon Operators

- PagePlus Cellular, Walmart Family Mobile, Straight Talk

T-Mobile Operators

- Spot Mobile, GoSmart Mobile, PlatinumTel, SIMPLE Mobile

More of these MNVOs are opening (and closing) every month. Luckily, a reader later pointed out that there is now a Wikipedia page that tracks all of these : http://en.wikipedia.org/wiki/List_of_United_States_mobile_virtual_network_operators

(…more to come…)

Footnotes:

1 – The Airvoice $10 refill glitch:

Update as of March 29, 2013: It looks like this has been fixed – the company now offers automatic renewal and credit card billing at the end of the month, just like every other monthly service in the world. So it’s convenient at last.

Here’s the old problem, which has now been solved, just in case it comes up again:

When we first learned about Airvoice, the $10.00 plan worked exactly as you’d expect it to: you can pay $10 for 30 days, or you can buy multiple $10.00 credits and have them stack up in your account, and at the end of each month (or when your 250 minutes gets used up), you automatically move on and start nibbling upon the next $10.00 credit with a fresh 30-days-later expiration date. It would make sense to buy at least a few months at a time, both for efficiency, and because of the following inconvenient policy on the Airvoice site:

To avoid service interruption, you will need to add a new refill card to your account before your airtime expires. Once your airtime expires, you will have 30 days to add a refill card. If no card is added, your account will be canceled. You will lose your phone number. If you wish to restore service after your account is canceled, you will need a new phone number and a new Airvoice SIM card.

However, they recently changed it so that if you buy a $10.00 credit, you get extra minutes, but your account is only extended by 30 days from the date of purchase. So you are doomed to having to log into the site manually to purchase airtime every single month. No automatic renewal, no possible way to make it convenient to give the company your money. Is this company run by former Soviet administrators!?

I couldn’t believe such a change would happen. So we contacted their headquarters, told them we were writing an article, and received this response:

We are consulting with our IT department and are working on reversing this change that has occurred. Hopefully, within the next couple of weeks, the plan will revert back to the original policy, where each $10 refill will provide an additional 30 days. For the time being, however, the expiration date will only extend as far as 30 days from the present date.We appreciate your patience and understanding on this matter.Thank you,

Airvoice Wireless

And therein lies the challenge of this whole operation. These little companies are small and disorganized. Airvoice has some of the most poorly written and inconsistent sets of plan options and marketing documents I’ve ever seen. And most of the other ones, such as H20 Wireless, are in the same boat. Even the slew of options available from the big incumbent providers are sprawling, and as confusing as spaghetti*. The only carrier that does it right is the upstart Republic Wireless, which is why I’m rooting for them.

Luckily, the phone service itself is still fairly reliable and the telephone customer support from Airvoice has been excellent… so far.

*Hey Airvoice.. need someone to rewrite your materials and plans so they no longer suck? Get in touch!